Tuomas Kosonen

I'm Research Professor at VATT Institute for Economic Research in Helsinki, Finland. I have a PhD in economics from University of Helsinki. My research focuses on public economics and labor economics. My recent publications are on behavioral effects of consumption and income taxes.

I have a new webpage that I update from now on: link to the new page

MY LATEST RESEARCH

Tax Compliance in the Rental Housing Market: Evidence from a Field Experiment

with Essi Eerola (Bank of Finland), Kaisa Kotakorpi (Tampere University) and Teemu Lyytikäinen (VATT)

Conditionally accepted to American Economic Journal: Economic Policy

Paper: link to paper

Abstract:

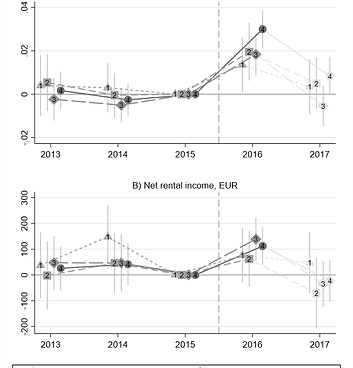

We study rental income tax compliance using novel third-party information and a large-scale randomized field experiment. The third-party information combines register data on the ownership and occupancy of apartments. %The RCT sent information letters about the usage of this new third-party information in tax enforcement.

The RCT used this new third-party information in the targeting and design of experimental treatments, and increased the propensity to report rental income and the amount of reported rental income net of expenses. Our research design also allows us to identify members of ownership networks and analyze spillover effects in tax enforcement between them. We find positive reporting spillovers. We do not find evidence of real effects on asset market transactions.

When Are Sin Taxes Effective? From Substitution to Elasticities

with Sami Jysmä (LABORE) and Riikka Savolainen (Swansea)

Abstract

This paper studies when are sin taxes and other targeted consumption taxes effective in affecting consumption. We organize the paper through a simple model that characterizes how consumer preferences between two goods are related to elasticity of consumption. The model yields as a result a pattern where demand elasticity is very small otherwise, but when the two goods are very close substitutes the elasticity suddenly explodes to a large level. Empirically we analyze a Finnish sin tax scheme for sweets, soda and ice cream providing us with quasi-experimental variation through multiple reforms. We have product and store-level data on sales and prices containing hundreds of millions of observations. We also provide survey evidence on substitution preferences across categories of goods. Our estimated consumption elasticity is close to zero for sweets and ice cream that have intermediate non-taxed substitute: cookies. In a stark contrast, when the tax rate was doubled for sugary soft drinks but not for their very close substitute non-sugary soft drinks, consumption elasticity is close to unity. These estimates align well with our theory framework. We also provide a meta-analysis to literature analyzing consumption elasticities and show that the elasticity estimates align with our theory framework.

Discrete Labor Supply: Empirical Evidence and Implications

with Tuomas Matikka (VATT)

Abstract

We provide evidence of discrete labor supply and study the broader implications of discrete responses for estimating earnings elasticities. We utilize an income notch and a reform that shifted the location of the notch to study labor supply mechanisms. We find transparent reduced-form evidence that this reform caused large earnings responses from a broad income range in the distribution, which is consistent with discrete labor supply. We then illustrate that conventional welfare-loss estimates can be downward-biased when labor supply is discrete instead of continuous.

What Goes Up May Not Come Down: Asymmetric Incidence of Value Added Taxes

with Youssef Benzarti (UCSB), Dorian Carloni (CBO) and Jarkko Harju (VATT) Journal of Political Economy, Vol. 128, No. 12, 2020.

This paper shows that prices respond more to increases than to decreases in Value-Added Taxes (VAT). First, we combine monthly commodity price data with information on VAT reforms across European countries from 1996 to 2015 to show that prices respond 3 to 4 times more to VAT increases than decreases. Second, we show that the asymmetry persists over several years. Third, we document several empirical features of this asymmetry that are inconsistent with the standard incidence model, such as distributional asymmetry. We provide evidence consistent with firm behavior driving the asymmetry.

Paying Moms to Stay Home: Short and Long Run Effects on Parents and Children

with Jon Gruber (MIT), Kristiina Huttunen (Aalto University)

NBER WP 2/2023, VATT WP 12/2022, Conditionally accepted to Journal of Public Economics

Child penalty in Finland and the estimated effect of abolishing home care subsidies on that in red

Abstract

We study the impacts of policy induced home care or day care decisions by parents on parents' and children’s short- and long-term outcomes. We are able to utilize regional and over time exogenous variation in child home care allowance that significantly increases incentives to stay at home and take care of children that are under the age of three in Finland. Our results show that home care allowance decreases maternal employment in short and long term. The effects are large enough for the existence of home care benefit system to explain a substantial part of short-term child penalty. Home care benefits also negatively affect the early childhood cognitive test results of children at the age of five, increase the likelihood of choosing vocational rather than academic secondary education track, decrease likelihood of enrolling to college and increase youth crimes. The results are more pronounced in municipalities that have higher average child care quality. We additionally utilize a day care fee (DCF) reform that created exogenous variation in DCFs. Reducing DCF increased labor force participation of mothers and participation of children to day care, and improved child early test and schooling outcomes. The results indicate that universal child policies can have substantial impact on the subsequent lives of children.

The heterogeneous incidence of fuel carbon taxes: Evidence from station-level data

with Jarkko Harju (Tampere University), Marita Laukkanen (VATT) and Kimmo Palanne (Aalto university and VATT)

Abstract

We use station-level price data and a significant diesel fuel carbon tax reform to study who bears the economic burden of fuel carbon taxes. We use a difference-in-differences strategy to estimate the pass-through of the large carbon tax increase to retail prices, where we compare retail diesel prices faced by private motorists to retail gasoline prices. We find that on average fuel carbon taxes are less than fully passed through to consumer prices, which suggests that consumers and the supply chain split the burden of these taxes. Using information on station location, we match price observations with postcode-level average incomes and measures of urbanization, and show that there are significant differences in the pass-through rate across areal incomes and between rural and urban areas up to one year after the reform. The effect of fuel carbon taxes on consumer prices decreases with areal income and with the degree of urbanization.

The Impact of Foreign Acquisitions on Top Incomes

with David Autor (MIT), Matti Sarvimäki (Aalto), Lauri Turkia (Tampere) and Tuomo Virkola (VATT)

Abstract

What are the effect of foreign ownership in the labor markets? This paper studies this question utilizing microdata from Finland and a reform in 1993 that made foreign ownership of firms unrestricted in Finland. We focus on the effect on top incomes, ans also address important spillovers to other firms.

Missing Miles: Avoidance and Evasion Responses to Car Taxes

with Jarkko Harju (VATT) and Joel Slemrod (UMich) Journal of Public Economics, vol. 181, 2020.

We study tax avoidance and evasion responses to extensive import car taxes in Finland. We do this by exploiting a series of policy reforms in Finland, by utilizing novel third-party comparison information, and by analyzing a randomized control trial that varies the salience of the third-party information and a public disclosure program that renders less attractive car tax evasion achieved by overstating the mileage of imported used cars. The results suggest that car taxes in Finland induce car buyers to avoid some of the taxes by importing used cars from other countries without a high car import car tax. Moreover, we find systematic evidence of tax evasion in the form of “missing miles.” The tax evasion leads to a significant loss of tax revenue and is positively related to CO2 emissions and the tax rate. Increasing the salience of the anti-evasion initiatives reduced reported the overstatement of mileage.

Firm types, price-setting strategies, and consumption-tax incidence

with Jarkko Harju (VATT) and Oskar Nordström Skans (Uppsala)

Journal of Public Economics, vol. 165, pages 48–72, 2018

We analyze price responses to large restaurant VAT rate reductions in two different European countries and show that price responses in the short and medium run were clustered around two focal points of zero pass-through and full pass-through. Differences between independent restaurants and chains is the key explanation for this pattern. While nearly all independent restaurants effectively ignored the tax reductions and left consumer prices unchanged, a substantial fraction of restaurants belonging to chains chose a rapid and complete pass-through. In the longer run, prices converged, but primarily through a price reversion among chain restaurants. The stark difference in price responses cannot be explained by location, initial prices or other market-segment indicators such as meal or restaurant types. Further evidence on the use of round-number pricing, on price-change frequencies, and on pricing behavior during currency conversions suggests that the diverging price responses to consumption-tax reforms reflect fundamental differences in price-setting behavior between the two types of firms.

What Goes Up May Not Come Down: Asymmetric Incidence of Value Added Taxes

with Youssef Benzarti (UCSB), Dorian Carloni (CBO) and Jarkko Harju (VATT) Journal of Political Economy, Vol. 128, No. 12, 2020.

This paper shows that prices respond more to increases than to decreases in Value-Added Taxes (VAT). First, we combine monthly commodity price data with information on VAT reforms across European countries from 1996 to 2015 to show that prices respond 3 to 4 times more to VAT increases than decreases. Second, we show that the asymmetry persists over several years. Third, we document several empirical features of this asymmetry that are inconsistent with the standard incidence model, such as distributional asymmetry. We provide evidence consistent with firm behavior driving the asymmetry.